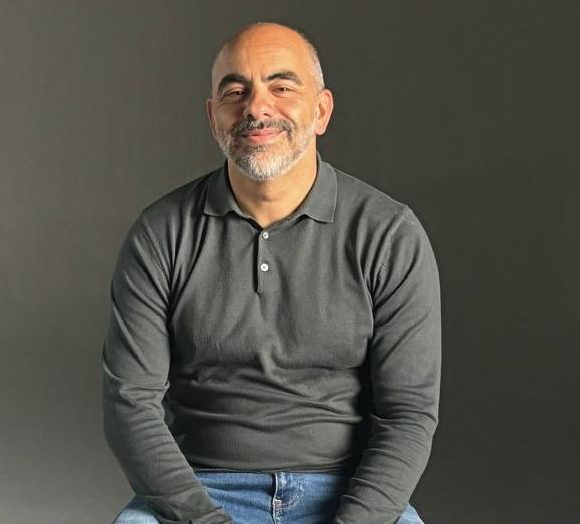

Pleased To Meet You

Recently remarried, family man, and part-time BBQ king. My two teenage sons, 18 and 14, keep me busy with their weekend football matches — I’m basically their unpaid Uber driver, coach, and sideline cheerleader, rain or shine.

When I’m not pitch-side or flipping burgers, you’ll find me exploring the great outdoors with our dog Rocco — whether it’s a peaceful stroll along the river or a deep dive into the forest.

I’m a proud West Ham United supporter — I grew up just a stone’s throw from the Upton Park stadium and have witnessed the highs, and quite a lot of lows (more than I’d like to admit). My 45-year marriage to West Ham not only shows my loyalty but also reflects the strength and passion I bring to all areas of my life.

At home or at work, I value honesty, dedication, and keeping things simple. I’m lucky to share life with my brilliant wife, who keeps everything running smoothly — and even holds the umbrella while I stubbornly BBQ in the rain.

Turan

So, how I Can Help You Find the Perfect Mortgage?

I’m a mortgage advisor who believes in straight-talking, stress-free advice — no confusing jargon, no pushy sales talk, just honest guidance to help you make one of life’s biggest decisions with confidence. Whether you're a first-time buyer, remortgaging, or building your property portfolio, I’m here to make the process as smooth as possible (and maybe even enjoyable — imagine that!).

I understand that everyone’s financial situation is unique, which is why I take a personalised approach to help you find the right mortgage. I know that dealing with finances can sometimes feel overwhelming, so I prioritise getting to know you, your goals, and what you want to achieve through detailed life planning and one-on-one consultations.

I’ll guide you through every step of the process—explaining your options clearly, helping you choose the best mortgage for your needs, and ensuring you have the right protection in place for you and your family. With access to over 10,000 mortgage deals, I’m committed to finding the perfect solution tailored just for you.

Having worked as an adviser for many years, I still love what I do. Building strong relationships with my clients is important to me, and many come through referrals from those who have already experienced my service. That trust is the highest compliment I could receive.

What NUBO Stands For

Well, the name "Nubo" is inspired by the Latin word for "cloud," representing flexibility, clarity, and modern solutions. But it stands for much more than just that:

- N – Navigating the mortgage process with ease and simplicity.

- U – Understanding your unique needs and finding the right solution for you.

- B – Bespoke advice and tailored mortgage options to suit your individual circumstances.

- O – Openness and transparency in everything I do, ensuring you feel confident every step of the way.

Additionally, Nubo represents New Borrowing, with "Nu" offering a modern twist on the word "new," symbolizing a fresh and innovative approach to securing finance. The "BO" stands for Borrowing, reflecting the core focus of the business—helping you find the right mortgage and financial solutions.

Just like a cloud that shifts and adapts to its environment, Nubo is here to help guide you through your mortgage journey with a flexible, clear, and supportive approach. Whether you're a first-time buyer, looking to remortgage, or facing complex financial circumstances, Nubo will find a solution that fit your needs.